Zora

New member

1. Introduction

Welcome to the wild world of Solana meme coin trading! Solana’s fast, low-cost blockchain has become a hotbed for meme coins like $BONK, $WIF, and $SAMO, offering massive opportunities but also high risks. Success in this market requires discipline, a solid strategy, and the right tools. This guide will walk you through a step-by-step approach to trading Solana meme coins, from research to profit-taking, with a focus on building your capital reserve and managing risk.

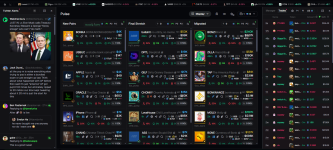

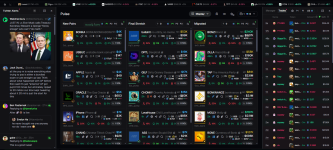

To stay ahead in this fast-paced market, tools like Axiom are essential. Axiom is the ultimate trading bot for Solana meme coins, leveraging real-time X sentiment analysis and wallet tracking to spot whale movements and market trends before they emerge. Sign up using my referral link to receive a 10% discount on fees. Combined with active engagement in Solana’s X community (#Solana, #MemeCoin) and platforms like Dexscreener, this guide will equip you to navigate the meme coin trenches and come out profitable. here is an example of my Axiom setup. Let’s dive in!

2. Understand the Law of Averages & Trade Sizing

• Success in Solana meme coin trading relies on the law of averages: consistent small wins compound over time. Know when to size in and when to take profits.

• If your capital is low, become the ULTIMATE 2X TRADER

– Take profits when your position doubles your entry price (e.g., buy at $0.01, sell at $0.02)

– Accumulate 40 bets of the same size before increasing bet size to maintain discipline.

• This strategy ensures steady compounding without overexposing your portfolio.

• Diversify by holding 3–5 Solana meme coins to spread risk, as these tokens are highly volatile.

• Use Solana-based wallets like Phantom or Solflare to manage trades efficiently.

3. Portfolio Building: Focus on Growing Your Capital Reserve

• Aim for steady portfolio growth by chasing high-probability trades, not quick riches.

• Define your goals: quick flips (1–3 days), medium-term (1–2 weeks), or long-term holds (1–3 months).

• For long-term holds, focus on fundamentally strong Solana meme coins like $BONK or $WIF, which have community backing and exchange listings. Buy dips for 20–50% gains.

• Reinvest profits into your capital reserve to increase position sizes over time.

• Monitor Solana’s ecosystem growth (e.g., DeFi, NFTs) to identify meme coins tied to trending narratives.

• Consider staking stable Solana tokens (e.g., USDC on Orca) during market downturns to preserve capital.

4. Create an Effective Trading Plan

• A trading plan enforces consistency and discipline in the fast-paced Solana meme coin market.

• Simple plan with key elements:

– Fundamentals: Look for coins with a unique narrative (e.g., dog-themed, gaming), 200+ holders, KOL buzz on X, and high trading volume on Raydium or Orca.

– Analysis: Identify accumulation zones, support levels, and bullish momentum us- ing tools like Dexscreener or Birdeye.

– Entry: Risk 5% of your portfolio per trade; add another 5% if the price dips 10– 15% and momentum remains strong.

– Profits: Sell 50% at 100% gain, 25% at 150%, and keep a small “moonbag” for potential 10x+ pumps.

– Loss: Sell 50% at your predefined loss threshold (e.g., 20%), full exit if support breaks or volume dries up.

• Customize your plan based on your risk tolerance and trading style (scalping, swing, or HODL).

• Adjust position sizes during bullish or bearish market cycles to optimize returns.

5. Research and Validate Coins Thoroughly

• Equipment: An older device works fine, but ensure you have a secure Solana wallet (e.g., Phantom) and access to trading platforms like Raydium or Jupiter.

• Research Tips:

– Seek coins with strong narratives (e.g., meme appeal, Solana ecosystem tie-ins) or viral potential.

– Check X for real-time sentiment: Search coin tickers (e.g., $WIF, $MEOW) to gauge community hype and KOL endorsements.

– Join active Telegram or Discord communities to monitor engagement and developer activity.

– Use Dexscreener (dexscreener.com) to verify healthy trading volume, liquidity, and top holder distribution (avoid coins with >10% held by one wallet).

– Research team track records via their X profiles or project websites.

– For advanced insights, use Axiom, the best trading bot for Solana meme coins, featuring X sentiment analysis and wallet tracking to monitor whale movements and liquidity pools. Sign up with my referral link for a 10% discount on fees: Axiom Referral Link

• Analyze failed meme coins (e.g., low volume, rug pulls) to sharpen your due diligence skills.

• Follow Solana influencers on X like @solanatrader or @degenexpress for alpha on new launches.

• Use on-chain tools like Solscan to check token contracts and burn history for added safety.

Once you’ve identified a coin with a promising narrative or simply like it enough to hold, it’s critical to dig deeper for bearish and bullish signals to manage your risk effectively. Does your coin have a future, or is it likely to moon and dump to zero? Is there potential for your coin to be PvP’d (i.e., is there an identical “OG coin” posted before it)? These are key questions to answer before committing to a trade. There’s nothing to teach here directly, but be aware that mastering this skill often comes through experience and learning from mistakes—a crucial part of becoming a successful trader.

If you’re in a coin before it’s bonded or during bonding, perform these basic checks to assess its potential and risks:

Understanding whether a coin is dev-based or narrative-based is crucial, especially if it’s bundled, as it affects how you interpret bearish signals:

Summary: Your goal is to search for strong narratives efficiently while managing risk by identifying bearish signals. Combining these checks with your initial research will help you avoid rug pulls and focus on coins with real potential.

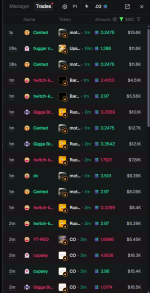

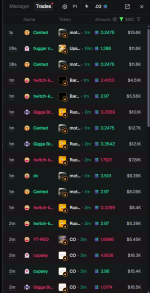

Wallet tracking is a powerful yet often overlooked strategy, utilized by nearly every consistently profitable trader. It’s a tool to catch coins you might have missed while not actively monitoring new pairs, gain early alpha on projects the public doesn’t yet know about, and broaden your view of market activity. While you’re focused on another coin or taking a break from trading, seeing multiple tracked wallets—or even a single high-win-rate wallet—buying a coin can prompt you to quickly research it and decide if it’s worth investing in. Wallet tracking gives you an edge by revealing market moves in real-time.

However, do not confuse wallet tracking with copy trading. Wallet tracking is for gathering information, not as a direct buy signal. Copy trading often leads to losses—around 80% of copy traders lose money due to delays, high fees, and competition from others copying the same wallet. To profit consistently from copy trading, you’d need an exceptional RPC/server setup, which isn’t practical for most. Instead, use wallet tracking to inform your own research and decision-making process.

Finding wallets to track is a skill in itself. Many traders are protective of their lists because they’ve worked hard to curate them. Sharing a wallet publicly can lead to it becoming less effective if the wallet owner creates a new one to avoid being tracked.

To find good wallets:

I’m sharing a list of wallets I’m currently tracking on Axiom. Just comment here "I NEED THE LIST" and I will dm you the list. You can set up your own tracking by signing up with my referral link for a 10% discount on fees: Axiom Referral Link. The list includes over 100 wallets of KOLs, whales, and notable traders, each with a name and tracked wallet address (see Appendix A). Use this list to start your own research and identify opportunities.

When a coin you believed in goes to zero, take the opportunity to reflect on what went wrong to refine your approach:

Each failure offers a chance to strengthen your decision-making.

Overtrading in Solana’s fast-moving meme coin market can lead to unnecessary losses, inconsistency, and burnout. Learn to recognize when it’s time to step back to protect your capital and mental clarity.

Signs You Need a Break:

Rules for Pausing:

Market Conditions:

Balance trading with life—step away from charts to avoid obsession.

Engage with the Solana community on X to stay motivated and grounded (e.g., #Solana, #MemeCoin).

Establish a daily routine to maintain a focused mindset:

Insights into analyzing Solana meme coins across market cap ranges and key patterns:

Market Cap Ranges:

Key Technical Patterns:

I encourage everyone to read through this guide, whether you’re starting with zero Solana or managing a 1,000 SOL portfolio. Recently, I launched a new Telegram channel (https://t.me/zoracooks) and Twitter (https://x.com/zoracooks) to share calls and foster a community.

If this guide has helped, I’d appreciate it if you’d consider signing up for Axiom with my referral link and following my channels. We’ll print together!

If you have questions about meme coin trading, Axiom setup, or anything else, feel free to reach out to me directly here or on Twitter.

Good luck in the trenches—let’s thrive!

Welcome to the wild world of Solana meme coin trading! Solana’s fast, low-cost blockchain has become a hotbed for meme coins like $BONK, $WIF, and $SAMO, offering massive opportunities but also high risks. Success in this market requires discipline, a solid strategy, and the right tools. This guide will walk you through a step-by-step approach to trading Solana meme coins, from research to profit-taking, with a focus on building your capital reserve and managing risk.

To stay ahead in this fast-paced market, tools like Axiom are essential. Axiom is the ultimate trading bot for Solana meme coins, leveraging real-time X sentiment analysis and wallet tracking to spot whale movements and market trends before they emerge. Sign up using my referral link to receive a 10% discount on fees. Combined with active engagement in Solana’s X community (#Solana, #MemeCoin) and platforms like Dexscreener, this guide will equip you to navigate the meme coin trenches and come out profitable. here is an example of my Axiom setup. Let’s dive in!

2. Understand the Law of Averages & Trade Sizing

• Success in Solana meme coin trading relies on the law of averages: consistent small wins compound over time. Know when to size in and when to take profits.

• If your capital is low, become the ULTIMATE 2X TRADER

– Take profits when your position doubles your entry price (e.g., buy at $0.01, sell at $0.02)

– Accumulate 40 bets of the same size before increasing bet size to maintain discipline.

• This strategy ensures steady compounding without overexposing your portfolio.

• Diversify by holding 3–5 Solana meme coins to spread risk, as these tokens are highly volatile.

• Use Solana-based wallets like Phantom or Solflare to manage trades efficiently.

3. Portfolio Building: Focus on Growing Your Capital Reserve

• Aim for steady portfolio growth by chasing high-probability trades, not quick riches.

• Define your goals: quick flips (1–3 days), medium-term (1–2 weeks), or long-term holds (1–3 months).

• For long-term holds, focus on fundamentally strong Solana meme coins like $BONK or $WIF, which have community backing and exchange listings. Buy dips for 20–50% gains.

• Reinvest profits into your capital reserve to increase position sizes over time.

• Monitor Solana’s ecosystem growth (e.g., DeFi, NFTs) to identify meme coins tied to trending narratives.

• Consider staking stable Solana tokens (e.g., USDC on Orca) during market downturns to preserve capital.

4. Create an Effective Trading Plan

• A trading plan enforces consistency and discipline in the fast-paced Solana meme coin market.

• Simple plan with key elements:

– Fundamentals: Look for coins with a unique narrative (e.g., dog-themed, gaming), 200+ holders, KOL buzz on X, and high trading volume on Raydium or Orca.

– Analysis: Identify accumulation zones, support levels, and bullish momentum us- ing tools like Dexscreener or Birdeye.

– Entry: Risk 5% of your portfolio per trade; add another 5% if the price dips 10– 15% and momentum remains strong.

– Profits: Sell 50% at 100% gain, 25% at 150%, and keep a small “moonbag” for potential 10x+ pumps.

– Loss: Sell 50% at your predefined loss threshold (e.g., 20%), full exit if support breaks or volume dries up.

• Customize your plan based on your risk tolerance and trading style (scalping, swing, or HODL).

• Adjust position sizes during bullish or bearish market cycles to optimize returns.

5. Research and Validate Coins Thoroughly

• Equipment: An older device works fine, but ensure you have a secure Solana wallet (e.g., Phantom) and access to trading platforms like Raydium or Jupiter.

• Research Tips:

– Seek coins with strong narratives (e.g., meme appeal, Solana ecosystem tie-ins) or viral potential.

– Check X for real-time sentiment: Search coin tickers (e.g., $WIF, $MEOW) to gauge community hype and KOL endorsements.

– Join active Telegram or Discord communities to monitor engagement and developer activity.

– Use Dexscreener (dexscreener.com) to verify healthy trading volume, liquidity, and top holder distribution (avoid coins with >10% held by one wallet).

– Research team track records via their X profiles or project websites.

– For advanced insights, use Axiom, the best trading bot for Solana meme coins, featuring X sentiment analysis and wallet tracking to monitor whale movements and liquidity pools. Sign up with my referral link for a 10% discount on fees: Axiom Referral Link

• Analyze failed meme coins (e.g., low volume, rug pulls) to sharpen your due diligence skills.

• Follow Solana influencers on X like @solanatrader or @degenexpress for alpha on new launches.

• Use on-chain tools like Solscan to check token contracts and burn history for added safety.

6. Advanced Risk Assessment: Bearish and Bullish Signals

Once you’ve identified a coin with a promising narrative or simply like it enough to hold, it’s critical to dig deeper for bearish and bullish signals to manage your risk effectively. Does your coin have a future, or is it likely to moon and dump to zero? Is there potential for your coin to be PvP’d (i.e., is there an identical “OG coin” posted before it)? These are key questions to answer before committing to a trade. There’s nothing to teach here directly, but be aware that mastering this skill often comes through experience and learning from mistakes—a crucial part of becoming a successful trader.

If you’re in a coin before it’s bonded or during bonding, perform these basic checks to assess its potential and risks:

- Is it Bundled?

Use tools like Axiom to easily check if a coin is bundled. A bundle isn’t inherently bad—it can help with price control if top holders are holding their bags. However, if a coin is bundled too hard (e.g., almost all holders are yellow people, rats, or snipers), it’s likely to either get no attention or rug hard. Check if bundled wallets are selling or holding to gauge the coin’s trajectory. - Flagged Insider Wallets:

Are there flagged insider wallets involved? This could indicate potential manipulation or dumping. - Top Holder Distribution:

Is there a ridiculously large top holder (e.g., holding >10% of supply)? This increases the risk of a dump. - Previous Iterations:

Has the same coin been done before and reached Raydium? If so, it might be a copycat with less potential. - Dev Holdings:

Is the dev still holding a significant portion of the supply? If yes, their actions will heavily influence the coin’s price. - Dev History:

Has the dev posted rugs previously? Research their track record to avoid scams. - Dev Wallet Funding:

Was the dev wallet funded from an exchange or a Solana wallet? Exchange-funded wallets can signal higher risk of a quick exit. - Selling Pressure:

Are snipers and top holders consistently selling? This is a bearish signal. - Volume Trends:

Is trading volume slowing down? Declining volume often precedes a price drop. - Art Originality (for Art Coins):

If it’s an art coin, is the art stolen? Use reverse image searching to verify originality. Similarly, check if the main image is original and trace its source. - Website Authenticity:

Is the website copied or fake? A copied website is a red flag for a scam.

7. Dev-Based vs. Narrative-Based Coins

Understanding whether a coin is dev-based or narrative-based is crucial, especially if it’s bundled, as it affects how you interpret bearish signals:

- Dev-Based Coins:

These coins rely heavily on the developer. Examples include coins tied to an AI or website created by the dev—if the dev disappears, the coin likely goes to zero. If you’re in a dev-based coin and notice constant selling from top holders and sniper wallets (a sign the dev, who bundled the coin, is dumping), it’s a strong bearish signal. The dev is likely taking profits with no intention of pushing the project further. In this case, it’s best to take profits or exit the coin entirely. - Narrative-Based Coins:

These coins pump based on their own momentum and community support, independent of the dev. If the dev sells, it might not matter—and could even fuel the pump. However, if the coin is narrative-based but the dev has bundled a lot of the supply, they might start dumping as soon as the coin hits Raydium. Your job is to monitor buy pressure versus sell pressure and decide if the coin’s narrative is strong enough to push through the dev’s selling on alt wallets.

Summary: Your goal is to search for strong narratives efficiently while managing risk by identifying bearish signals. Combining these checks with your initial research will help you avoid rug pulls and focus on coins with real potential.

8. Wallet Tracking: Learn from KOLs and Whales

Wallet tracking is a powerful yet often overlooked strategy, utilized by nearly every consistently profitable trader. It’s a tool to catch coins you might have missed while not actively monitoring new pairs, gain early alpha on projects the public doesn’t yet know about, and broaden your view of market activity. While you’re focused on another coin or taking a break from trading, seeing multiple tracked wallets—or even a single high-win-rate wallet—buying a coin can prompt you to quickly research it and decide if it’s worth investing in. Wallet tracking gives you an edge by revealing market moves in real-time.

However, do not confuse wallet tracking with copy trading. Wallet tracking is for gathering information, not as a direct buy signal. Copy trading often leads to losses—around 80% of copy traders lose money due to delays, high fees, and competition from others copying the same wallet. To profit consistently from copy trading, you’d need an exceptional RPC/server setup, which isn’t practical for most. Instead, use wallet tracking to inform your own research and decision-making process.

Finding wallets to track is a skill in itself. Many traders are protective of their lists because they’ve worked hard to curate them. Sharing a wallet publicly can lead to it becoming less effective if the wallet owner creates a new one to avoid being tracked.

To find good wallets:

- Check recent high-performing coins and sift through their top traders.

- Use tools like Cielo to analyze a wallet’s profitability and determine if it’s popular or low-key.

- If you’re in communities with successful traders, search their posted PNLs, match them with a coin’s top traders, and identify their wallets that way.

I’m sharing a list of wallets I’m currently tracking on Axiom. Just comment here "I NEED THE LIST" and I will dm you the list. You can set up your own tracking by signing up with my referral link for a 10% discount on fees: Axiom Referral Link. The list includes over 100 wallets of KOLs, whales, and notable traders, each with a name and tracked wallet address (see Appendix A). Use this list to start your own research and identify opportunities.

9. Mastering the Art of Taking Profits

- Recover your initial investment early to reduce risk and stress.

- Set profit targets based on risk level:

- High-risk coins: 30–60% gains (e.g., new launches with low liquidity).

- Moderate-risk coins: 50–75% gains (e.g., established meme coins like $SAMO).

- Low-risk coins: 80–120% gains (e.g., coins with CEX listings like $BONK).

- Take profits at key resistance levels (check Dexscreener charts) or psychological price points (e.g., $0.01, $0.1).

- Avoid holding forever or selling emotionally during pumps—stick to your plan. Don’t let impatience or fear lead to unnecessary losses. Ask yourself: “Why am I giving my money away for free?” Protect your capital like it’s gold.

- Use profits to fund new trades or stake in Solana DeFi for passive income.

- Consider partial profit-taking during hype cycles to lock in gains before corrections.

10. Managing Losses and Risk Effectively

- Cut losses quickly to avoid emotional spirals in volatile meme coin markets.

- Exit trades when:

- Sentiment on X or Telegram fades (e.g., less shilling, negative posts).

- Key support levels break (check 4HR charts on Dexscreener).

- Insiders or whales dump (track via Axiom’s wallet tracker).

- Set stop losses 10–20% below support levels to limit downside.

- Mentally prepare for losses—meme coins are high-risk, and not every trade will win.

- Keep a trading journal to review losses and improve decision-making.

- Hedge risk by diversifying into stablecoins during uncertain market conditions.

11. Learn From Failed Trades

When a coin you believed in goes to zero, take the opportunity to reflect on what went wrong to refine your approach:

- Was the liquidity pool (LP) burnt? A non-burnt LP can signal a higher rug-pull risk.

- Were the holders or Telegram activity indicators strong? Weak community engagement is a red flag.

- Did the trading volume and holder percentages align with expectations? Low volume or imbalanced holder distribution can indicate a lack of sustainability.

Each failure offers a chance to strengthen your decision-making.

12. Avoid Overtrading & Know When to Pause

Overtrading in Solana’s fast-moving meme coin market can lead to unnecessary losses, inconsistency, and burnout. Learn to recognize when it’s time to step back to protect your capital and mental clarity.

Signs You Need a Break:

- A string of 2–3 consecutive losses (strategy may not be working).

- Lack of confidence in trades, leading to hesitation or poor decisions.

- Reduced motivation or discipline, causing you to deviate from your plan.

Rules for Pausing:

- Use profit milestones as cues:

- “Once I achieve a 50% portfolio growth, I’ll pause trading for the day.”

- Limit the number of trades:

- “After 1–2 trades per day, or if I feel burned out, I’ll take a break.”

Market Conditions:

- If market conditions aren’t favorable or your strategy isn’t performing, stop trading and wait. The market will always present new opportunities.

Balance trading with life—step away from charts to avoid obsession.

Engage with the Solana community on X to stay motivated and grounded (e.g., #Solana, #MemeCoin).

13. Daily Trading Workflow and Habits

Establish a daily routine to maintain a focused mindset:

- Start your day with a clear head:

- Analyze the market by reviewing current conditions—scan X for trending Solana meme coins to gauge sentiment.

- Check Dexscreener for volume and liquidity spikes.

- Use Axiom’s trading bot to automate entries based on X sentiment and wallet activity.

- Warm up by placing small trades to test momentum.

- Take profits regularly—whether you sell in chunks or all at once, lock in gains.

- Avoid revenge trading after losses—stick to your plan.

- Take breaks to maintain clarity and balance life outside trading.

- Build a social network on X with traders and degens to share alpha and stay informed (e.g., follow @solana_memes).

14. Additional Expert Tips

- Don’t wait for KOL calls—proactively research new launches on Raydium or Pump.fun.

- Use Axiom to track X sentiment and whale wallets for early signals.

- Top blasting (buying early in a launch) works for high-potential coins with strong community buzz.

- If you sell early, reduce position size or keep a small external bag for moonshots.

- Scale out when X posts explode with bullish sentiment (e.g., #ToTheMoon).

- Avoid forcing trades in choppy, low-volume markets.

- Steer clear of revenge trading and overtrading.

- Play your own game—don’t blindly follow X hype or FOMO into bad trades.

- Use Jupiter Aggregator for optimal trade execution.

- Monitor liquidity pool changes on Raydium to spot potential pumps or dumps.

15. Technical Analysis Tools

Insights into analyzing Solana meme coins across market cap ranges and key patterns:

Market Cap Ranges:

- Sub $1M Marketcap:

- Risky with many underperforming projects; high rug-pull potential.

- New launches especially prone to early dumps.

- Use high-interest contract scanners with caution.

- Avoid expecting sustained success without strong fundamentals.

- $1M–$10M Marketcap:

- Still volatile but lower rug risk.

- Look for strong price action and retracements at support zones.

- Favor launches with 2–5% market cap to profit potential.

- Position sizing: 0.1–1% of supply or scale based on market cap.

- $10M–$100M Marketcap:

- Focus on projects with strong holder growth.

- Good profit-taking opportunities.

- Aligned influencers and whales can drive price—prioritize those with staying power.

- Avoid derivative plays without real utility.

- $100M–$1B Marketcap:

- Limit position size to manage risk.

- Seek market leaders with mainstream adoption potential.

- Use tools to identify holder strength and support levels (e.g., Fibonacci retracements).

- Avoid beta plays with temporary pumps.

Key Technical Patterns:

- Momentum Shifts:

- Look for LH/HH forming new market structure.

- Use volume or RSI for confirmation.

- For entries, target 0.786 Fib or bullish zones.

- Accumulation Zones:

- Defined consolidation after a dump.

- May signal a breakout.

- ATH Breakouts:

- Watch for flips from resistance to support.

- Fibonacci Retracement:

- Use 0.618 level for entries; 0.786 for trend revival.

- Support & Resistance Levels:

- Watch S/R flips, previous ATH breakouts, double bottoms.

16. Final Notes

- Discipline, not luck, drives success in Solana meme coin trading.

- Take consistent profits to build your capital reserve.

- Manage risk tightly to survive volatility.

- Stay grounded—avoid getting swept up in hype.

- Celebrate small wins—a 20% gain or a well-timed exit.

- There’s always another trade—don’t dwell on losses or missed pumps.

- Surround yourself with hardworking traders on X or build your own crew via Telegram or Discord.

- Connect with the Solana meme coin community to find alpha and share tips.

I encourage everyone to read through this guide, whether you’re starting with zero Solana or managing a 1,000 SOL portfolio. Recently, I launched a new Telegram channel (https://t.me/zoracooks) and Twitter (https://x.com/zoracooks) to share calls and foster a community.

If this guide has helped, I’d appreciate it if you’d consider signing up for Axiom with my referral link and following my channels. We’ll print together!

If you have questions about meme coin trading, Axiom setup, or anything else, feel free to reach out to me directly here or on Twitter.

Good luck in the trenches—let’s thrive!